|

3rd

Quarter Wrap Up

from Realty Masters in Pensacola!

Can

you believe

we are a month away from Thanksgiving?

Here in the Florida Panhandle, we had our first day with temps below 60 degrees and *hopefully* our final tropical weather scare of the

year, while some of

you have already had your first snow of the

season.

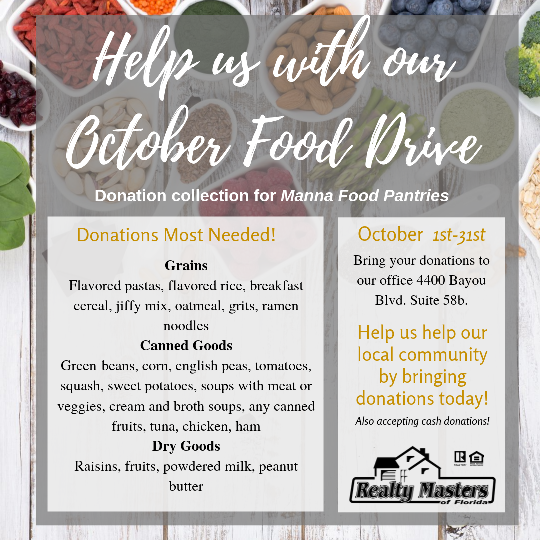

This quarter's newsletter contains: -ECUA Sewer Averaging -Average Life Span of Appliances -Roofs & Other Insurance Issues -Donate to our Food Drive -Disparate Impact Laws & Felonies -Zillow Changes Advertising Structure -Consider a Tenant Gift this Holiday Season or a Renewal Incentive -The Price You Pay- Maintenance Expenses -Year End Tax Items including Invest in your Property, Capital Gains Taxes, and Opportunity Zones -Pensacola Real Estate Market Update |

|

|

|

|

|

Roofs & Other Insurance Issues

in Pensacola

As most roofs that were replaced after Hurricane Ivan are now 15 years old, the Pensacola area is being inundated with insurance and financing issues surrounding one of the major (and most expensive) components of your home- your roof! We've seen the following roof and insurance related issues: -Current owners experiencing difficulties renewing an insurance policy -Current owners receiving a letter from their existing insurance carrier stating they need to trim trees or replace their roof in order to keep coverage -Current owners trying to change insurance companies -Sellers trying to sell their properties having to a replace a roof that isn't leaking to close -Buyers trying to buy a property with an older roof unable to secure financing In addition to roof repairs and replacement requests from insurance companies, there's been an increase in insurance companies requiring the following: -A flat switch for your HVAC that shuts the unit off in case of a water backup -A pan required under the HVAC unit indoors -A pan required under the water heater As these items were not previously required to be up to code, they are now, and you may consider having these items done at your rental property if they are not in place already. We have discussed this topic in length in previous newsletters and on our blogs! Here's a few articles for more information in case you missed it. - Impact of Hurricane Michael on the Pensacola Area - Does it need a New Roof? If your roof is approaching this 20 year mark, you need to consider setting aside money for roof replacement in the near future. Also, consider these issues when you are deciding whether to repair or replace a roof that is leaking or having other issues. You may repair an area of your roof only to find the roof needs additional repair soon after, and then, ultimately replacement. These funds may be better spent on a total replacement. |

|

Disparate Impact

Laws and Felonies

A few years ago, the Department of Housing and Urban Development issued a guideline stating that blanket screening policies that deny applicants with felonies can be discriminatory. Since then, we have updated our application and screening procedures to take into effect the disparate impact guideline. While we wait for HUD and Fair Housing to issue further guidelines on this topic, we are finding that lawsuits in relation to this topic are being filed all over the state of Florida (and likely the country). Watch this video from our friends at Florida Realtors that discusses this topic in further detail. 48 Florida Housing Providers Sued for Allegedly Refusing 'Prior Felony' Tenants What does this mean? Whereas we used to blanket deny anyone with felonies, we are no longer able to do this and need to consider each tenant on a case by case basis and consider a lengthy list of factors including the entire application, type of conviction, history since conviction, and any rehabilitation done since the conviction. We stay up to date with new laws by being active participants in the National Association of Residential Property Managers, National Association of Realtors, and from Chesser & Barr, our legal counsel. |

|

Zillow Charging for Rental Listings in Florida

As of October 1, 2019, Zillow began charging for single family rental listings on their website! For years, we were able to list on Zillow manually and through a feed at no charge. Florida rental listings are now $10 per week per listing in order to post on Zillow. Zillow is apparently testing this in three states- Florida, Colorado, and Oregon, but does plan to roll this out to other states in the future and will likely expand to real estate listings for sale if it's successful in the rental testing. What does this mean for us? Nothing! As of now, we have no need to change our marketing strategy. While our feed from our management software is no longer active, we list each and every property in the local MLS and this feed is still active. Your listings will still appear on Zillow and the Zillow network but may take a day or two longer to appear as they will come through the MLS feed. |

|

Consider a Tenant Gift this Holiday Season or Providing an Incentive at Renewal

Time!

Everyone loves a little holiday cheer. Providing your tenants with a small gift during the month of December goes a long way for goodwill throughout the rest of the year. A small investment can make a large impact on your tenants. While this is definitely not required, it's especially nice to consider your tenants if you've had a great tenant or one that has been in place long term. Here's a few ideas on gestures you can make to increase goodwill with your tenants this holiday season! Gifts and other gift giving approaches:

Give the gift of deep cleaning or one time lawn clean up!

Making repairs or upgrades to your home:

If you are interested in any of these ideas, reply to this email or reach out to your property manager and we can help to execute it for you! |

|

|

One issue

that can cause a long repair response time is a home warranty. For example,

an AC breaks in the middle

of summer. A certain part is needed, but

the home warranty cannot get that part for another ten

days and after it finally comes in, it may be another two days before the appointment

can be scheduled

for installation. That is an unreasonable

amount of time to make a tenant go without AC. Chances

are, your tenant is going to want to stay somewhere else in the meantime.

They may also seek reimbursement

for their expenses along with

a rent abatement. So, while you think you are only paying the

minimal service fee to the home warranty, you may also end up losing a few

hundred more dollars

depending on the amount of rent and expenses

you agree to credit. After that all adds up, it’s that

likely you could have saved a bunch of time, hassle, and money had you

chosen for a vendor

outside of the warranty company to make

the repair the same or next day, for $200 or less in most cases

that we’ve seen. You keep a tenant happy as well!

Such an ordeal can leave a bitter taste in the tenant’s mouth. It may also be one of the main reasons they feel the need to vacate upon lease expiration which will result in a vacancy and additional turnover expenses. Was waiting the extended amount of time to try and save some money worth damaging your relationship with your tenant? Valuable time may also be wasted if you require multiple estimates for a repair. Two estimates can usually give you a good idea of what you can expect to fork out, but wanting to get three or four estimates not only increases the repair time, but also increases your tenant’s frustration. Many factors contribute to the relationships we have with tenants. The most common feedback we get from tenants includes the condition of the properties they live in, communication, and maintenance request response times. We work every day to improve in all of those categories and we act as a liaison and at times, a mediator, between you and the tenant. While we represent you, we do make sure we are providing an objective outlook on all situations so things may be handled as quickly, efficiently, and as smoothly as possible. Just keep in mind that sometimes you may need to pay a little more to have a little less trouble with your tenant/landlord relationship. |

|

|

|

Opportunity Zones & Avoiding Capital Gains Taxes

When it comes to capital gains taxes, there's been a lot of talk this year about Opportunity Zones and a new way to reinvest funds that would have normally been paid towards capital gains taxes in real estate in low income zones designated "opportunity zones." The Tax Cuts and Jobs Act of 2017 in conjunction with the Internal Revenue Code Section 1400Z provides new tax incentives in the way of exchanging capital gains if reinvested and held in accordance to the rules outlined. This rule applies until 2026. We're surely not CPA's and this topic digs quite deep into tax code so always consult your tax professionals before moving forward with an investment plan that involves significant tax implications. HUD has now created a website with information to further explain Opportunity Zones. Visit it here as it applies for the entire U.S. and not just the Pensacola area. https://opportunityzones.hud.gov/ and includes a map to show certified opportunity zones. The Florida Department of Economic Opportunity also has a variety of information about Opportunity Zones on their website here. In Pensacola, there are limited zones identified as Opportunity Zones and includes 5 small areas in Pensacola, a portion of Milton, Florida and most of the city of Century, Florida.

We're happy to run searches for properties located in the Pensacola opportunity zones for you. Definitely reach out to your accountant or CPA for more information on this topic and with your specific questions. |

|

Pensacola

Real Estate Market Stats

How's the Pensacola real estate market doing? Here's some single family market statistics from the Pensacola MLS for the 3rd quarter of 2019.

Interested in multi-family sales? We've got some statistics for you year to date!

|

|

|

|

Realty Masters of Florida

4400 Bayou Blvd 58B, Pensacola, FL 32503 Rental Office Call us Monday- Saturday at 850.473.3983 Info@PensacolaRealtyMasters.com www.PensacolaRealtyMasters.com 4400 Bayou Blvd 52B, Pensacola, FL 32503 Sales Office Call us Monday- Friday 850.453.9220 Pam@PensacolaRealtyMasters.com www.Pensacola-Gulfbreezehomes.com

LET'S CONNECT

|